2 Stocks Standing Out In The Internet Software & Services Industry

About The Industry

The Internet Software & Services industry is a relatively small industry primarily involved in enabling platforms, networks, solutions and services for online businesses and facilitating customer interaction and use of Internet based services.

Factors Driving The Industry

- The overall impact of COVID has been mixed for the industry. Although it necessitated work from home for employees, the industry, being by nature tech-centric, had relatively fewer issues with this. On the other hand, business continuity concerns accelerated the shift to cloud-based working for many companies, while service providers, both work-related and otherwise, also moved to Internet-based channels. Another big segment that did humongous amounts of online business was retail. All of these moves were positive for the industry (in terms of revenue) and partially offset the negative impact of declining business at brick-and-mortar players. At least some of the positives will outlive the pandemic. In other cases, the return to physical operations is still ongoing, and hindered by new strains of the virus, inflation and other concerns.

- The geopolitical tensions in Europe have a bearing on oil prices and certain supply chains, and therefore, also on large segments of the economy. And some experts fear that the Fed’s actions to contain inflation could have a deflationary impact in the current environment. Since any improvement in the general level of economic growth improves prospects for the industry, the current environment is contributing to the negative outlook.

- The higher volume of business being operated through the cloud and the increasing demand for enabling software and services involves infrastructure buildout, which increases costs for players. This causes great fluctuations in profitability as new infrastructure is depreciated and fresh debt is serviced. So even for the players for whom revenue growth has accelerated, the pandemic exacerbated this situation leading to weak profitability in 2020 with 2021 growing slightly off 2020 levels but well short of 2019 levels.

- The level of technology adoption by businesses and the proliferation of connected consumer devices that might help people connect and do business online also impacts growth. The high penetration of mobile devices among users and the pandemic-driven necessity is driving more businesses to adopt technology that they earlier stayed away from because of the cost involved. This is positive for the industry.

Zacks Industry Rank Indicates Continued Challenges

The Zacks Internet – Software & Services industry is housed within the broader Zacks Computer and Technology sector. It carries a Zacks Industry Rank #200, which places it in the top 21{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} of more than 250 Zacks classified industries. Our research shows that the top 50{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} of the Zacks-ranked industries outperforms the bottom 50{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} by a factor of more than 2 to 1.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates that while the industry is recovering from pandemic-inflicted problems, certain issues remain.

The industry’s positioning in the bottom 50{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} of Zacks-ranked industries is because the earnings outlook for the constituent companies in aggregate continues to deteriorate. Looking at the aggregate estimate revisions, it appears that analyst confidence in the group’s earnings growth potential for 2022 has been on a more or less steady decline since last April. Over the past year, the 2022 average earnings estimate is down 42.9{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847}. The estimate for 2023 slid even more, declining 51{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} from last April.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

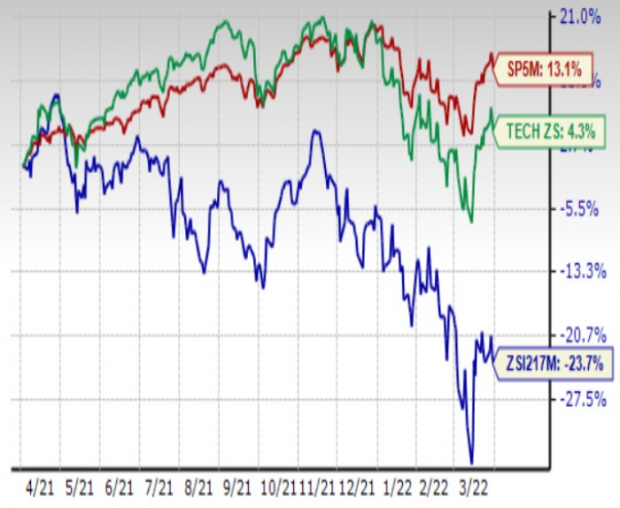

Industry’s Stock Market Performance Is Suffering

The past year’s performance of the Zacks Internet – Software & Services Industry shows that it has mostly lagged the broader Zacks Computer and Technology Sector, as well as the S&P 500.

Aggregate share price of the industry dropped 22.7{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} over the past year compared to the broader sector’s increase of 6.3{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} and the S&P 500’s increase of 15.0{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847}.

One-Year Price Performance

Image Source: Zacks Investment Research

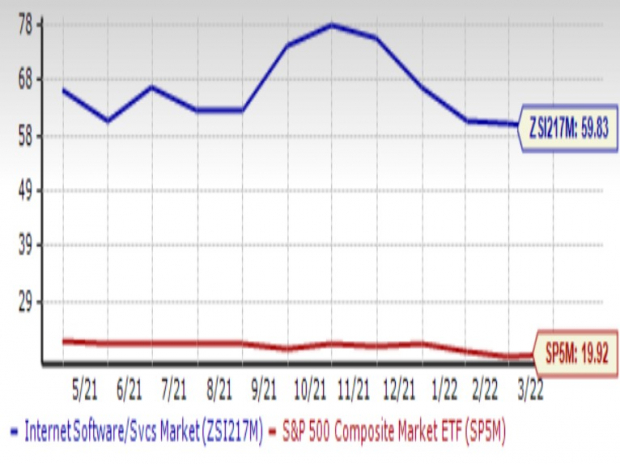

Industry’s Current Valuation

While many of the players are still making losses, the industry as a whole continues to generate profits. So on the basis of forward 12-month price-to-earnings (P/E) ratio, we see that the industry is currently trading at 60.6X, close to its highest multiple of 64.6X over the past year. The S&P 500’s P/E is 20.25X (21.66X at its median value). The industry is also overvalued compared to the sector’s forward-12-month P/E of 24.74X (close to its lowest point over the past year).

The industry has traded in the annual range of 64.57X to 77.89X, as the chart below shows.

Forward 12 Month Price-to-Earnings (P/E) Ratio

Image Source: Zacks Investment Research

2 Stocks Worth Considering

Globant S.A. GLOB: Luxembourg-based Globant offers a broad range of technology services covering engineering, design and innovation. These services are used in ecommerce and other product distribution-related systems; finance-related systems; and game and graphic engineering systems. It also offers a range of other services. Since these services facilitate the digital transformation of companies, Globant is positioned to grow for years to come.

Globant has a roster of big clients and it continues to target big customers. Additionally, it seeks to deepen relationships with these big customers to generate a steady flow of revenue. This is evident from the fact that its clientele grew 42{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} in 2021 with clients spending over $1 million growing 43{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847}.

This Zacks Rank #2 company is up 24.8{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} over the past year. The Zacks Consensus Estimate for the 2022 EPS increased 44 cents (9.8{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847}) in the last 60 days. The estimate for 2023 increased 49 cents (8.8{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847}).

Price and Consensus: GLOB

Image Source: Zacks Investment Research

VeriSign VRSN: VeriSign provides Internet infrastructure services, including primarily domain name registry services and also infrastructure assurance services.

Verisign is benefiting from a growing trend in new domain name registrations as well as price increases of up to 7{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} pursuant to the Third Amendment to the .com Registry Agreement with ICANN. The steady nature of the business that is tied to digital transformation leads to relatively steady cash flows. A couple of concerns include softening renewals of new/first-time renewal businesses (related to macro concerns and search algorithms) and competition from Google’s free public domain name service.

This Zacks Rank #2 company is up 10.2{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} over the past year. The Zacks Consensus Estimate for the 2022 EPS is unchanged in the last 60 days while the estimate for 2023 is up a couple of cents.

Price and Consensus: VRSN

Image Source: Zacks Investment Research

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} or more in 2021. Previous recommendations have soared +143.0{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847}, +175.9{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847}, +498.3{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} and +673.0{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847}.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.