3 Picks from the Recovering Internet Software & Services Industry

The outlook for the Internet-Software & Services industry appears mixed. The lackluster performance towards the beginning of the year is mainly related to the lingering effects of the pandemic, which has hurt a number of players. Estimates have been increasing since May, as the pandemic recedes. Some companies were however positively impacted by the pandemic and the rush-to-digitize trend that it gave rise to. The diversity of players in this group leads to some dissonance.

Being the backbone of the digital economy, it’s hard to see this industry doing badly over the long term. Overall, some of these long-term trends are playing out this year even as concerns of a slowing economy in 2023 looms large. The negative economic indicators, inflation and geopolitical tensions affect most players but some are better equipped than others to deal with the situation.

Despite the beating that the industry has taken this year, valuation still looks rich. But this may be just the time to find beaten-down stocks with better staying power or strong long-term potential. Our picks are NetEase (NTES), RingCentral (RNG) and Verisign (VRSN).

About The Industry

The Internet Software & Services industry is a relatively small industry, primarily involved in enabling platforms, networks, solutions and services for online businesses and facilitating customer interaction and use of Internet based services.

Top Themes Driving the Industry

-

The overall impact of COVID has been mixed for the industry. Although it necessitated work from home for employees, the industry, being by nature tech-centric, had relatively fewer issues with this. On the other hand, business continuity concerns accelerated the shift to cloud-based working for many companies, while service providers, both work-related and otherwise, also moved to Internet-based channels. Another big segment that did humongous amounts of online business was retail. All of these moves were positive for the industry (in terms of revenue) and partially offset the negative impact of declining business at brick-and-mortar players. At least some of the positives will outlive the pandemic. In other cases, the return to physical operations is still ongoing, and hindered by new strains of the virus, inflation and other concerns.

-

The geopolitical tensions in Europe have a bearing on oil prices and certain supply chains, and therefore, also on large segments of the economy. And most experts fear that the Fed’s actions to contain inflation are pushing us into a recession. Since any improvement in the general level of economic growth improves prospects for the industry, the current environment is contributing to a negative outlook for 2023.

-

The higher volume of business being operated through the cloud and the increasing demand for enabling software and services involves infrastructure buildout, which increases costs for players. This causes great fluctuations in profitability as new infrastructure is depreciated and fresh debt is serviced. So even for those players that have seen revenue growth accelerate as a result of the pandemic, profitability has remained a challenge. The current inflationary conditions are also a concern.

-

The level of technology adoption by businesses and the proliferation of connected consumer devices that might help people connect and do business online also impacts growth. The high penetration of mobile devices among users and the pandemic-driven necessity is driving more businesses to adopt technology that they earlier stayed away from because of the cost involved. This is positive for the industry.

Zacks Industry Rank Indicates Improving Prospects

The Zacks Internet – Software & Services industry is housed within the broader Zacks Computer and Technology sector. It carries a Zacks Industry Rank #93, which places it in the top 37{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} of more than 250 Zacks classified industries. Our research shows that the top 50{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} of the Zacks-ranked industries outperforms the bottom 50{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} by a factor of more than 2 to 1.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates that the industry is currently in recovery mode.

The industry’s positioning in the top 50{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} of Zacks-ranked industries is because the earnings outlook for the constituent companies in aggregate is improving. The aggregate estimate revisions reflect increased analyst optimism since May and the group’s aggregate earnings are now down just 1.6{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} over the past year. The 2023 estimate is however still down 35{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847}.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

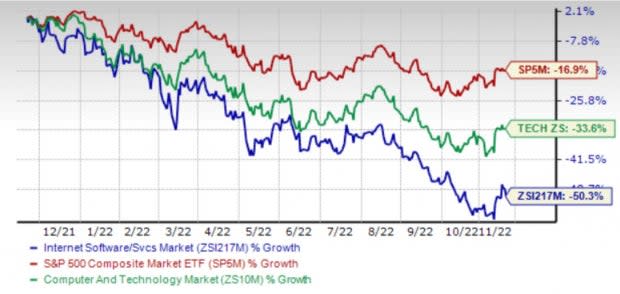

Industry’s Stock Market Performance Remains Poor

The past year’s performance of the Zacks Internet – Software & Services Industry shows that it has lagged the broader Zacks Computer and Technology Sector, as well as the S&P 500 during this period. But while the discount to the S&P 500 is substantial, especially in the last few months, it has traded closer to the sector, which hasn’t had a great run in the face of current macro concerns.

The aggregate share price of the industry dropped 50.3{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} over the past year compared to the broader sector’s decline of 33.6{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} and the S&P 500’s decline of 16.9{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847}.

One-Year Price Performance

Image Source: Zacks Investment Research

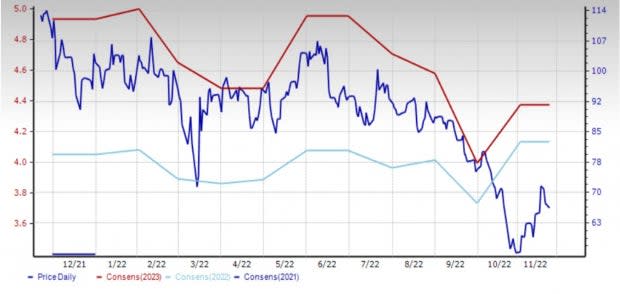

Industry’s Current Valuation

While many of the players are still making losses, the industry as a whole continues to generate profits. Therefore, on the basis of forward 12-month price-to-earnings (P/E) ratio, we see that the industry is currently trading at a 30.7X multiple, well below its median level of 52.6X over the past year. The S&P 500’s P/E is however just 17.7X (median value over the past year is 17.9X). The industry is also overvalued compared to the sector’s forward-12-month P/E of 21.1X (at its median level over the past year).

The industry has traded in the annual range of 75.1X to 29.0X, as the chart below shows.

Forward 12 Month Price-to-Earnings (P/E) Ratio

Image Source: Zacks Investment Research

3 Stocks Worth Considering

NetEase, Inc. (NTES): Hangzhou-based NetEase provides online services focusing on diverse content, including games, music, other services and education (dictionary, translation and including a range of smart devices) in China. Its products and services are focused on community, communication and commerce.

NetEase is currently building its international business through fresh gaming content that appeals to an international audience. For this purpose, it has also established its own studios in Japan, Europe and North America, and is building creative talent in these regions. It is also expanding reach beyond PCs and mobile devices to consoles and facilitate gameplay seamlessly across devices, which further helps to grow the user base. Its education tools are very popular, as seen from the high revenue growth rate. The music business continues to grow with daily and monthly users holding steady even as the advertising-supported tier returns. Additionally, the content library continues to grow.

Shares of this Zacks Rank #2 (Buy) company have sunk 41.5{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} over the past year. The Zacks Consensus Estimate for the 2022 loss EPS has increased 37 cents (8.5{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847}) in the last 60 days. The 2023 earnings estimate has increased 35 cents (7.6{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847}).

Price and Consensus: NTES

Image Source: Zacks Investment Research

RingCentral, Inc. (RNG): Belmont, CA-based RingCentral provides software-as-a-service solutions that enable North American businesses to communicate, collaborate and connect. The company offers business cloud communications and contact center solutions. It caters to a enterprises, SMBs, professionals and others across a broad range of industries including financial services, education, healthcare, legal services, real estate, retail, technology, insurance, construction, hospitality, and state and local government.

RingCentral is growing on the back of a several megatrends, including the pandemic-induced shift to hybrid work, the increasing adoption of mobility solutions by businesses and the increasingly distributed workforces, all of which are leading to the increased need for unified communications and contact center solutions. When these are cloud-enabled, the whole thing is better integrated, more secure, more efficient and cost efficient. With an ecosystem of over 75,000 developers, over 150 pre-built telephony apps and over 330 pre-built apps as unified communications and contact center solutions, it is no surprise that Gartner has RingCentral in the leadership quadrant of its latest report. The company is already generating a recurring revenue run rate of $2 billion and looks set to easily eclipse that next year.

All this doesn’t of course doesn’t mean that the company is not seeing the economic slowdown and labor cost inflation that the rest of the market is seeing. Management has been rationalizing the workforce to align it with the changing market scenario. But it doesn’t take away from the fact that this is a rapidly expanding market the world over with a very low (single-digit) penetration rate, according to Synergy Research. Additionally, Synergy estimates that RingCentral is the leader in UCaaS with over 20{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} market share based on paid seats, which is double the second and third place vendors. So, there is tremendous scope for growth.

Shares of this Zacks Rank #2 company are down 83.5{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} over the past year. Its 2022 estimate is up 4 cents (2.1{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847}) in the last 60 days. The 2023 estimate is up 28 cents (11.2{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847}) during the same time period.

Price and Consensus: RNG

Image Source: Zacks Investment Research

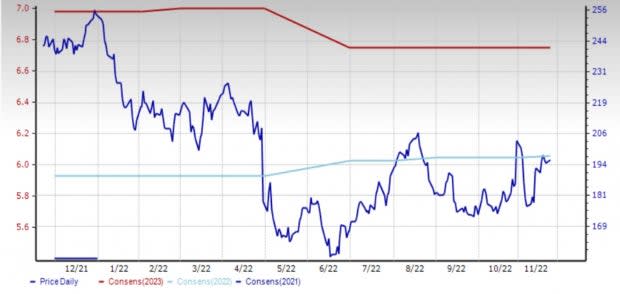

VeriSign, Inc. (VRSN): Reston, Va-based VeriSign provides Internet infrastructure services, including primarily domain name registry services and also infrastructure assurance services.

Verisign is benefiting from price increases of up to 7{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} pursuant to the Third Amendment to the .com Registry Agreement with ICANN and up to 10{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} in the .net registrations. The steady nature of the business that is tied to digital transformation leads to relatively steady cash flows. However, like every other company, rising costs, the broader economic slowdown and weaker business in China are also weighing on it. Competition from Google’s free public domain name service is also a concern.

Shares of this Zacks Rank #2 company have dropped 19.1{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} over the past year. The Zacks Consensus Estimate for the 2022 EPS is up a penny while that for the 2023 EPS is unchanged in the last 60 days.

Price and Consensus: VRSN

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

VeriSign, Inc. (VRSN) : Free Stock Analysis Report

NetEase, Inc. (NTES) : Free Stock Analysis Report

Ringcentral, Inc. (RNG) : Free Stock Analysis Report