Bentley Systems Stock: Important Player In GIS Software (NASDAQ:BSY)

Ungrim/iStock via Getty Images

Introducing Bentley Systems

Bentley Systems (NASDAQ:BSY) is an American-based provider of solutions that are related to infrastructure design, development, and operation to engineers, architects, GIS professionals, builders, and owner-operators. Furthermore, the software makes digital workflows possible covering different technical specialties, distributed project teams, office and field locations, and many computing platforms. The company serves its services worldwide.

Industry Outlook

Bentley Systems offers many different solutions, so it’s difficult to point out a single industry to analyze. However, most of its solutions fall directly or indirectly into the Geographic Information Software market.

Software for geographic information systems analyzes, stores, and manipulates geographic data. Due to factors such as:

- Rising demand for GIS solutions in the transportation and logistics industries

- The rapid development of GIS software in smart city projects and urban planning

- A rise in spatial data proliferation

- An increase in the demand for accurate location intelligence for targeted marketing efforts and site inspections, the market for geographic information system software could grow at a rapid rate in the future.

According to Allied Market Research data, the geographic information system (GIS) software market, which was valued at $6.3 billion in 2020, is anticipated to increase at a CAGR of 15.2{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} from 2021 to 2030, reaching a projected $25.5 billion.

Competition

The markets that Bentley Systems competes in are quite fierce. There are a lot of big, publicly traded, international companies out there competing:

-

In the field of industry and resources, AVEVA Group, Hexagon AB, and Dassault Systèmes are some of its rivals;

-

Autodesk, Trimble, and Nemetschek SE are some of its rivals in the commercial/facilities applications market;

-

Autodesk, Hexagon AB, Trimble, and Dassault Systèmes are some of its rivals in the field of public works and utilities;

-

Oregon Corporation and Autodesk are two of its rivals in project delivery systems;

-

In the field of asset performance systems, some of its rivals include Aspen Technology, AVEVA Group, Environmental Systems Research Institute, and General Electric.

|

Company |

Business Description |

Market Cap |

Last Year’s Revenue Growth |

|

Bentley Systems (BSY) |

Bentley Systems is an American-based provider of solutions that are related to infrastructure design, development, and operation to engineers, architects, GIS professionals, builders, and owner-operators. |

10.55B |

20.40{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} |

|

Autodesk (ADSK) |

Autodesk is a maker of application software that provides services to the media and entertainment, product design and manufacturing, architectural, engineering, and construction sectors. Autodesk was founded in 1982. |

42.57B |

15.72{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} |

|

Trimble (TRMB) |

Location-based services are offered by Trimble Inc. for use with GPS, laser, optical, and inertial technologies. 3D laser scanning, flow and application control systems, monitoring systems, water management, and navigation infrastructure are among its product offerings. |

15.80B |

16.25{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} |

|

Oracle (ORCL) |

Enterprises all across the world may purchase enterprise resource planning, or ERP, software from Oracle. Oracle was founded in 1977 as the first commercial SQL-based relational database management system. |

199.60B |

4.84{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} |

|

Aspen Technology (AZPN) |

Aspen Technology is a top provider of software solutions for complex industrial environments that enhance asset design, operations, and maintenance. |

11.31B |

690.12{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} |

Competitive Position

Comprehensive offering

Bentley Systems offers a very most comprehensive solution portfolios in the market, spanning professions, lifespan phases, infrastructural sectors, and geographical locations.

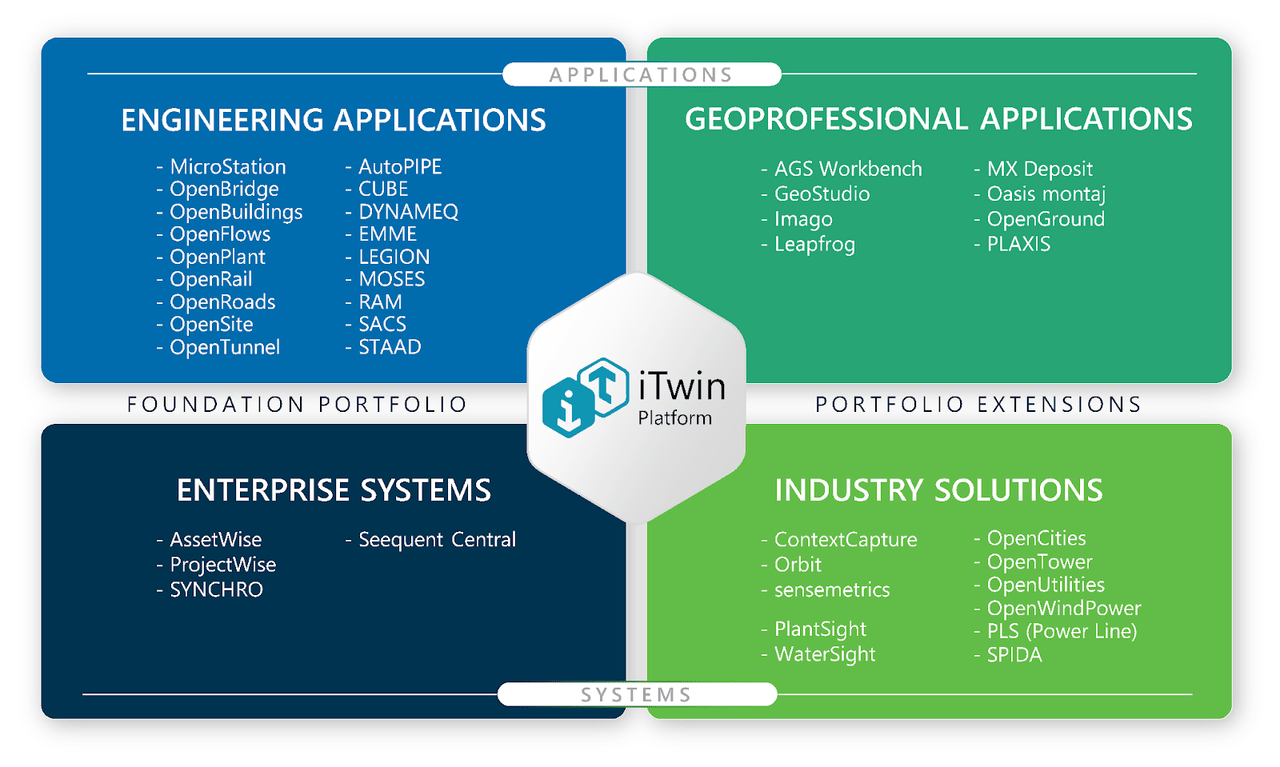

Solutions Bentley Systems (Latest annual report, Bentley Systems)

This potentially leads to several competitive advantages:

Infrastructure projects do necessitate seamless as well as frequent collaboration between the professional disciplines. The open modeling technologies of Bentley Systems enable frequent interactions between disciplines and collaboration among project participants.

An example in the latest annual report illustrates this advantage:

our offerings’ comprehensiveness can enhance both safety and economics by enriching the interfaces between geotechnical (earthworks) and structural analyses to share full 3D modeling details. Previously, structural decisions tended to be based on just a single imported parameter for subsurface foundation strength, frequently resulting in designs that included specifications and reinforcing materials beyond what was necessary to sufficiently mitigate risk.

Furthermore, its solutions serve project delivery businesses and owner-operators by allowing digital processes to cover the whole project and asset lifecycles. This enables users to use their digital engineering models as the context for real-time condition monitoring. This could potentially result in improved and safer operations and maintenance.

Its infrastructure modeling solutions may be utilized internationally because, notwithstanding country-specific design rules, infrastructure goals, and engineering procedures are universally applicable. Its project delivery accounts can compete more successfully across geographical markets due to its worldwide comprehensiveness.

Significant investments in Digital Twins

Using so-called “digital twins,” it is feasible to simulate the process of a project and show the visualization of how an infrastructure asset develops over time. Digital twins are updated continuously in a cloud database and stay current across the complete project and asset lifespan. Users are better able to comprehend how changes over time for projects and assets will affect them. This could help to increase project, construction, and operating efficiency. As a result, I believe that there is a huge market opportunity for this type of technology.

Bentley Systems invests a lot into the promising digital twin technology. The Bentley iTwin Ventures, a $100 million venture capital fund focused on co-investing in start-ups and emerging businesses developing digital twin solutions, was introduced in 2020. In order to integrate real-time data from sensors and other devices for geological, geotechnical, and environmental monitoring into the iTwin platform, it acquired sense metrics and Vista Data Vision in April 2021. Moreover, in March 2021, it also signed an agreement to acquire Seequent, a provider of 3D modeling software for geosciences.

Overall, I believe that Bentley Systems offers a comprehensive and effective solution, which can benefit a lot of different types of businesses. With significant investments in digital twin technology, it is set to potentially take advantage of a huge market opportunity.

Valuation and Performance

I computed several valuation and performance-related statistics for Bentley Systems and its competitors:

|

Company |

Forward PE |

Gross Margin |

Free Cash Flow Margin |

3Y sales growth |

3Y EPS growth |

Debt / Equity |

|

Bentley Systems |

42.02 |

78.10{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} |

23.59{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} |

11{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} |

-12{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} |

4.21 |

|

Autodesk |

26.88 |

90.31{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} |

34.33{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} |

19{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} |

– |

4.48 |

|

Trimble |

20.96 |

55.52{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} |

17.15{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} |

5{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} |

27{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} |

0.36 |

|

Oracle |

13.32 |

79.08{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} |

11.85{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} |

2{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} |

1{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} |

nan |

|

Aspen Technology |

33.56 |

46.75{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} |

nan |

– |

– |

0.03 |

Source: Seeking Alpha

The first point that I would like to make is that comparing these companies might not be 100{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} valuable but should rather be used as an indicator, as they all offer a large range of solutions in several different markets. Nevertheless, Bentley Systems is the most expensive company out of its competitors. Large investments in R&D, SG&A, and acquisitions have led to an EPS decrease over the years. In the forward PE ratio, analysts have taken into account a huge profit margin jump, as the trailing PE ratio is 126. I do believe that Bentley Systems does have a competitive offering to take advantage of a fast-growing and long-lasting market opportunity. Furthermore, as the company is still in its growth phase, I expect reasonable sales growth into the long-term future as well as profit margin expansion. As a result, I would say a PE ratio that is higher than the market average is fair. However, I do believe the forward PE ratio of 42 is a bit on the higher side, as Autodesk with high revenue growth is significantly cheaper. Trimble, with significant EPS growth, is even cheaper.

Final Take

I do like the offering of Bentley Systems and the market opportunities that it can take advantage of. In my opinion, its forward PE isn’t absurd high, but I do wish it would drop closer to 36 to 38. That’s why I am waiting for the price to drop in order for me to buy it.