Caterpillar (CAT) Hits 52-Week High: What’s Driving the Stock?

Shares of Caterpillar Inc. CAT scaled a new 52-week substantial of $258.58 on Jan 13, ahead of closing the session a tad lessen at $258.46.

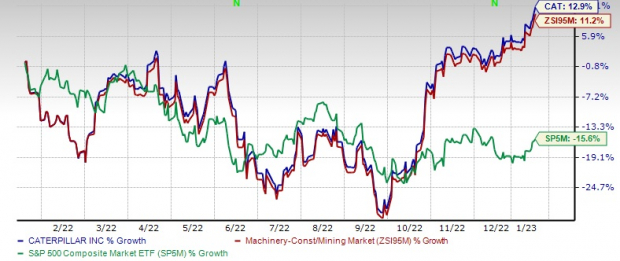

CAT has a current market capitalization of close to $134.5 billion. About the past calendar year, the CAT stock has acquired 12.9{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} in opposition to the 11.2{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} growth of the business. The S&P 500 composite has declined 15.6{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} in the same time frame.

Image Supply: Zacks Financial investment Analysis

What’s Driving Caterpillar?

The enterprise has amazed traders by offering development in both its prime and the bottom line for the very last couple of quarters. CAT’s earnings beat the Zacks Consensus Estimate in just about every of the trailing 4 quarters, the ordinary being 14.7{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847}.

Modified earnings for each share were being $3.95 in 3rd-quarter 2022, which marked a 48.5{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} advancement year about yr courtesy of robust demand from customers across its conclude markets. This, along with favorable selling price realization led to improved earnings regardless of unfavorable producing fees (largely bigger substance and freight expenses). The backlog at the stop of the quarter was an impressive $30 billion. This bodes effectively for CAT’s prime-line efficiency in the times ahead.

In North The us, desire in both of those household and non-residential development sectors is likely to bolster need for Caterpillar’s design machines. The perked-up investment decision in roads, bridges, airports and waterways as a consequence of the U.S. Infrastructure Investment decision and Work Act signifies a enormous prospect for CAT.

In the Resource Industries section, mining orders are on an uptrend, auguring well for the phase. Miners are progressively relying on autonomous systems to improve productiveness and lower fees and emissions. Therefore, CAT is enhancing its autonomous capabilities and bringing innovative goods to the industry.

Caterpillar just lately announced that it is investing in Lithos Vitality, Inc., a U.S.-based mostly battery engineering company that provides lithium-ion battery packs. This is in sync with the company’s motivation to supporting consumers in their energy changeover journey with reduce-carbon advanced power systems for its hybrid and total-electric equipment as effectively as ability technology products and solutions.

To this close, CAT lately exhibited four electric powered construction device prototypes, like battery prototypes, at bauma 2022 in Munich, Germany. It also successfully shown its initial battery electric 793 large mining truck at its Tucson Proving Ground in Arizona.

Earnings estimates for Caterpillar have also been heading up more than the previous 60 days. The Zacks Consensus Estimate for 2022 bottom line has amplified about .1{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} and the identical for 2023 has moved up 2.6{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847}. The consensus estimate for 3rd-quarter 2022 earnings (scheduled to be documented on Jan 31) has also been revised .8{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} upward in excess of the identical time body. The favorable estimate revisions instill investor’s self esteem in the inventory.

Zacks Rank & Stocks to Take into account

Caterpillar currently carries a Zacks Rank #3 (Maintain).

Some superior-ranked stocks from the Industrial Goods sector are KnowBe4, Inc. KNBE, Deere & Company DE and O-I Glass, Inc. OI. KNBE athletics a Zacks Rank #1 (Potent Invest in) at present, although DE and OI carry a Zacks Rank #2 (Purchase). You can see the complete listing of today’s Zacks #1 Rank stocks below.

KnowBe4’s earnings shock in the very last four quarters was 216.7{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847}, on regular. The Zacks Consensus Estimate for the company’s 2022 earnings is pegged at 25 cents, indicating a 12 months-over-calendar year improve of 127.3{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847}. The consensus estimate for 2022 earnings has moved up 25{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} in the past 60 days. KNBE’s shares have received 18{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} in a yr.

The Zacks Consensus Estimate for Deere & Company’s fiscal 2023 earnings for every share is pegged at $27.85, suggesting an raise of 19.6{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} from the last year’s noted determine. The consensus estimate for fiscal 2023 earnings moved 5.2{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} upward in the very last 60 days. DE has a trailing 4-quarter common earnings surprise of 7.1{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847}. Its shares obtained 16{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} in the last yr.

OI Glass has an average trailing four-quarter earnings surprise of 14.9{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847}. The Zacks Consensus Estimate for OI’s 2022 earnings is pegged at $2.25 for every share. This suggests a 22.9{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} maximize from the prior-yr documented determine. The consensus estimate for 2022 earnings has been unchanged in the previous 60 times. OI’s shares received 37{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} in the past yr.

Zacks Names “Single Very best Pick to Double”

From hundreds of stocks, 5 Zacks industry experts just about every have picked their favourite to skyrocket +100{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} or more in months to appear. From those people 5, Director of Research Sheraz Mian hand-picks just one to have the most explosive upside of all.

It’s a very little-recognised chemical enterprise which is up 65{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} above last year, but nevertheless filth affordable. With unrelenting demand from customers, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail buyers could leap in at any time.

This firm could rival or surpass other current Zacks’ Stocks Set to Double like Boston Beer Business which shot up +143.{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} in minor a lot more than 9 months and NVIDIA which boomed +175.9{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} in just one yr.

Absolutely free: See Our Major Stock and 4 Runners Up >>

OI Glass, Inc. (OI) : Totally free Stock Investigation Report

Caterpillar Inc. (CAT) : Free Inventory Investigation Report

Deere & Company (DE) : Absolutely free Inventory Evaluation Report

KnowBe4, Inc. (KNBE) : Free Stock Investigation Report

To browse this article on Zacks.com click on in this article.

Zacks Financial investment Exploration

The sights and opinions expressed herein are the sights and viewpoints of the creator and do not necessarily replicate people of Nasdaq, Inc.