Kentwood manufacturer’s bankruptcy filing highlights industry swings

KENTWOOD — A Grand Rapids-spot manufacturing group that produced new and important investments in the casino gaming device industry has filed for individual bankruptcy just after accumulating extra than $10 million in debt.

The new submitting is a reminder that many regional producers are continue to reeling from the fallout of the COVID-19 pandemic, like swings from periods of small to significant demand from customers and the conclude of federal reduction applications.

Laurie Harbour, president and CEO of Southfield-centered Harbour Final results Inc., said around a quarter of the hundreds of makers that her consulting company on a regular basis polls are continue to categorized as troubled.

“We’re viewing 25 to 30 percent that, until they transform their small business significantly, they’re likely to see some fate,” Harbour said. “That destiny could be remaining purchased or likely bankrupt — there will be some type of fate, it does not necessarily have to be terrible. They’re just battling fiscally. The federal (reduction) funding is absent and the battle ideal now on the source chain troubles are impacting people today.”

For TG Production LLC, that fate was Chapter 11 individual bankruptcy when it and various affiliates submitted with the U.S. Individual bankruptcy Court docket in the Western District of Michigan in late February. The corporation, which is headquartered at 4720 44th St. SE in Kentwood, consists of West Michigan-based subsidiaries A.I.M. Instrument & Die, Purpose Industries, Craft Steel, and Dorr Industries. TG Producing also owns Tupelo Device & Die in Tupelo, Miss.

Affiliated businesses TGM Coatings LLC and TG Turnkey LLC filed for Chapter 11 bankruptcy in February, though TG Integration LLC — with hopes of retaining economic solvency — submitted on March 27.

Owned by Richard Achtenberg with a full of 36 personnel, the 4 corporations are represented by Grand Rapids-based mostly individual bankruptcy and commercial litigation regulation agency Keller & Almassian PLC. A personal bankruptcy judge accepted a movement to jointly administer the conditions.

TG Production seeks to provide all of the entities as a heading problem and has held conversations with multiple fascinated functions, in accordance to an affidavit and sworn statement by President Kevin Kyle.

TG Manufacturing has shut its doors while TGM Coatings, TG Turnkey and TG Integration keep on being operational, in accordance to courtroom filings.

Attempts to access TG Producing ended up unsuccessful, and Keller & Almassian Partner Todd Almassian declined to remark.

Gambling on gambling

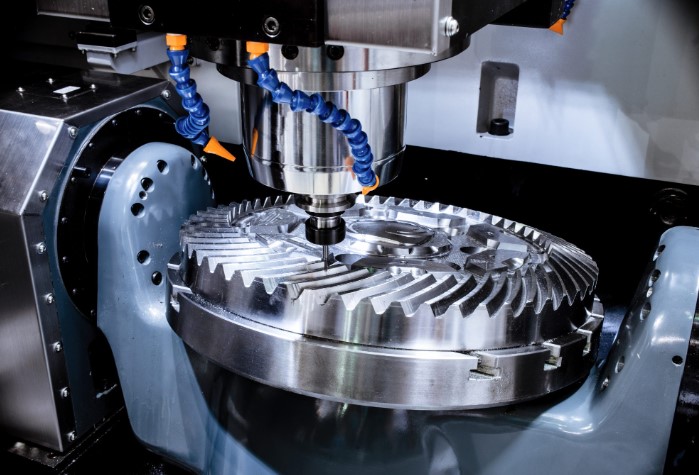

TG Producing specializes in developing material dealing with and automotive elements. Court docket paperwork discovered that, at its top, the enterprise generated as a great deal as $20 million in once-a-year revenue.

In accordance to Kyle’s affidavit submitted with the court, the organization in 2020 lost a contract with a “major shopper,” primary to a steep fall in sales. As the COVID-19 pandemic descended on the United States in March 2020, the automotive market was hit in particular hard as car or truck generation and its underlying provide chain encountered common disruptions.

TG Production then leaned into a growing phase of its business enterprise with the generation of casino gaming and enjoyment equipment, in accordance to the affidavit.

To placement alone in the current market, TG Manufacturing in June 2020 obtained the gaming equipment integration division of Grand Rapids-dependent Turnkey Fabrication LLC, which operated a 20,000-square-foot facility in Grand Rapids and equipped firms in the gaming sector throughout North America, as MiBiz previously described. That division was then structured underneath the TG Integration banner.

“Gaming device output is an thrilling sector to be in with incredible advancement prospective globally and we are excited to offer you some of the most vertically integrated merchandise in the field,” Achtenberg claimed when saying the offer final summer months.

The organization commenced its vertical integration tactic in the casino gaming sector the 12 months in advance of when it acquired Grand Rapids-centered A2Z Powder Coating, a supplier to the automotive, content managing and gaming industries. The 3 affiliated entities — TGM Coatings, TG Turnkey and TG Integration — worked jointly to vertically combine the system of making gaming devices.

Identical to the dynamic that played out in the automobile sector, the COVID-19 pandemic also rattled the on line casino marketplace as brick-and-mortar casinos were being quickly shut down under community health and fitness steps.

Prior to the downturn, TG Production, TGM Coatings and TG Turnkey sought to shore up their funds and tapped Bank of America in 2019 for a $5 million line of credit history and a expression financial loan of $2 million, according to courtroom documents. This funding was secured by the property of all 3 entities and also personally guaranteed by Achtenberg.

The entities defaulted on the bank loan, and in January of this calendar year, Bank of The us submitted a complaint in condition court docket seeking a court-appointed receiver. The three companies owed Bank of The usa roughly $6.2 million upon the time of filing, in accordance to courtroom documents.

To compound its fiscal woes, TG Production also was named in quite a few civil suits in Kent County Circuit Court docket for unpaid charges that have led to sizable judgments towards the firm. Around the last calendar year, the enterprise has faced almost a dozen civil grievances in circuit courtroom.

TG Production has skilled a number of judgments in favor of the company’s suppliers, like $1.5 million for Benteler Automotive Corp., $561,029 for Chicago-based mostly metal fabricator Lafayette Metal and Aluminum, and $96,563 for Birmingham, Ala.-primarily based industrial provide company GBA Offer Inc. All are labeled as unsecured claims in TG Manufacturing’s submitting.

Although TG Integration at first sought to avoid a Chapter 11 submitting, “based on developments that have occurred considering that the initial scenarios ended up filed, it has become clear that Integration would also have to have to file a chapter 11 continuing,” which transpired on March 27, according to Kyle’s affidavit.

In the meantime, a few of the affiliated providers obtained forgivable Paycheck Defense System loans totaling approximately $1.9 million among April 2020 and March 2021, in accordance to a application database. TG Production obtained $899,450 in April 2020 and yet another $756,685 in January 2021 TGM Coatings been given $145,165 in February 2021 and TG Integration received $90,962 in March 2021.

Danger looms

Harbour and her firm operate together with producers across the region. She underscored the worth of firm proprietors staying proactive and earning transformational improvements within just their businesses prior to encountering disputes with their bank.

“We like to do (turnarounds) proactively and get it in advance of the lender is breathing down your neck and pulling your line of credit rating,” Harbour said. “But, if they really do not do that, then the financial institution forces a person in there and then it turns into a total-on restructuring or liquidation or no matter what.”

Harbour mentioned suppliers have noticed desire swing in both instructions more than the past couple of decades, with issues emerging for the duration of each large and reduced periods. In the course of the peak of the pandemic, demand from customers dropped and turned very volatile during business enterprise shutdowns throughout the country. When the economic climate rebounded, Harbour claimed most sectors saw a approximately 30-percent raise in demand.

“There are two points that eliminate companies: No organization and much too substantially business, and not controlling it very well,” Harbour explained. “A whole lot of them received by way of the tricky times with federal funding and obtained way too a great deal desire and could not execute.”

For extra than a yr, personal bankruptcy attorneys have predicted an boost of bankruptcy filings that even now hasn’t materialized. A person West Michigan personal bankruptcy attorney instructed MiBiz that gurus relatively miscalculated how the pandemic and accompanying federal reduction would have an affect on the market, but that the similar fate however awaits.

“Once the pandemic strike, all the large boys submitted and then there was a lull and the govt pumped out income and there were being a lot of accommodations,” reported the legal professional, who asked for anonymity.

“The governing administration funds has operate out. The tough small business people today who were being arranged and in fantastic condition and not reliant on authorities dollars, they’ll survive. But I do predict, more than the subsequent 36 months now as the economic system recalibrates and you see inflation, I think you will see far more bankruptcies.”

Nevertheless, some brands remain well-positioned, Harbour stated. Corporations that ended up potent heading into the pandemic and made essential changes are finding an unparalleled time of new chance.

“I have companies that are landing transfer perform left and right since the large fellas know that so-and-so is likely to fall so they call someone else to get the small business,” Harbour explained.