Nidec Acquires Italian Machine Tool Manufacturer

Nidec Corporation introduced Wednesday that, in accordance with its Nov. 30 press launch, it has accomplished the acquisition of all the shares of PAMA S.p.A on Feb. 1.

Appropriately, PAMA will turn into a wholly owned subsidiary of the corporation as outlined beneath, jointly with Nidec’s organization method heading ahead.

Define of the New Subsidiary

- Company name: PAMA S.p.A.

- Headquarters: Rovereto, Trentino-Alto Adige, Italy

- Foundation: 1926

- New administration:

– Director & Chairperson: Tatsuya Nishimoto (Newly appointed)

– Director & Common Manager: Alessandro Batisti (Reelected)

– Director: Takeshi Motohashi (Recently elected) - Business enterprise bases: Manufacturing and income: Italy and China

- Product sales bases: U.S., Germany, India and some others

- Affiliates: 9 companies in China, the U.S., Germany, India and others

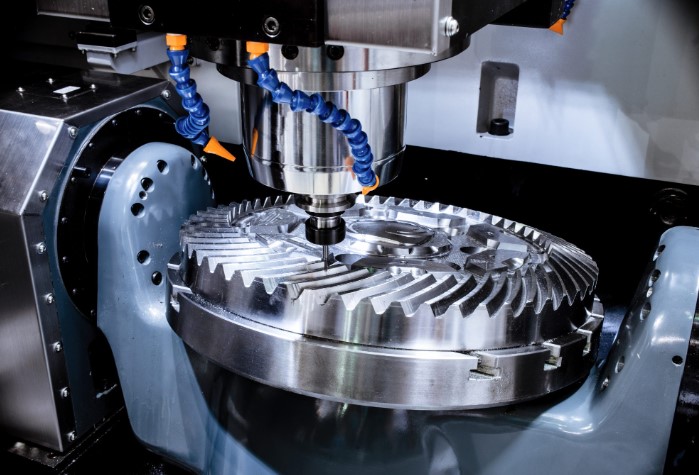

- Principal corporations: Producing and sale of equipment resources (dull and milling devices and machining centers, among the other people)

- Selection of employees: Roughly 430

- Income: Forecast as of the close of the fiscal yr ended Dec. 31: 135.6 million euro (approximately 19.12 billion yen)

PAMA’s Strengths

A enterprise with a wide products portfolio and high technological abilities in the fields of 5-face milling equipment, uninteresting and milling machines, and substantial device resources, PAMA features the world’s greatest market place share as a tedious and milling device producer. Close users incorporate key push device, building devices, heavy machine for vitality, earthmoving machine, shipbuilding and aerospace aircraft producers. In addition, PAMA enjoys stable annual profits in Europe, North The united states, and China – the state where by PAMA has been in business enterprise considering that 1988.

Developing Synergies with the Nidec Team

Nidec Equipment Instrument Corporation and Nidec OKK Company, two Nidec Group organizations whose major items are gear reducing devices, massive machine resources and machining centers, have been in want of further developing the multitasking and 5-axis machining engineering as very well as growing its lineup of dull and milling machines in the massive machine applications area. Also, the two companies’ major income area has been in Japan and, compared with other significant Japanese equipment software brands, the two organizations have produced fewer revenue from abroad markets these types of as European and American markets and Chinese marketplace, wherever the foreseeable future expansion is anticipated.

PAMA’s signing up for the Nidec Group will allow the Enterprise to pursue synergies in all the regions of sale, producing, and item improvement, like:

- expanding profits in the Asian, European and American markets centered on a extensive selection of item lineup and cross advertising

- establishing new products and components by combining the 3 companies’ technological skills and

- lowering direct time for shipping and producing price tag primarily based on a world-wide creation optimization in Europe, the US, and Asia.

What Nidec Aims to Accomplish with Its Machine Instrument Company

The once-a-year product sales of Nidec Device Instrument, Nidec OKK, and PAMA put together are close to 87 billion yen. By creating synergies among these a few firms and other Nidec Group organizations, and utilizing new M&As, the Business designs to accomplish revenue of much more than 260 billion yen in its equipment tool small business in the fiscal calendar year of 2025 (and 500 billion yen in the fiscal calendar year of 2030). Nidec stays dedicated to actively investing in the industry of machine resources, which are dubbed as “machines of machine” or “mother devices,” and contributing to the development of Japan’s machinery sector.

Consequences on Financial Efficiency for the Latest and Next Fiscal A long time

The Inventory Acquisition is anticipated to have no substantial influence on the Company’s consolidated fiscal functionality for this fiscal calendar year ending March 31, 2023. If essential, the Organization will make added disclosure on a well timed foundation in accordance with the rules of the Tokyo Inventory Trade on perseverance of further more particulars.