Nidec to Acquire Shares of Italian Machine Tool Manufacturer

Nidec Company announced Wednesday that the organization has passed a resolution to obtain the shares of Italian machine device producer PAMA and its 9 affiliate marketers on Nov. 28.

The company executed a transfer agreement on the stock acquisition on Nov. 30, as outlined under:

PAMA S.p.A.

Rovereto, Trentino-Alto Adige, Italy

Established: 1926

Director: Alessandro Batisti, common supervisor

Creation bases: Italy, China

Amount of workers: close to 430

Income: Fiscal calendar year finished December 31, 2021: 118.3 million euro

The firm entered into the device tool business enterprise on a entire scale after getting Mitsubishi Significant Industries Machine Resource Co., Ltd. (currently, Nidec Device Device Corporation) in August previous yr, and obtaining the shares of OKK Company (currently Nidec OKK Company) by means of a third-party allocation of common shares in February. With the most current buy of PAMA, the corporation will be able to accelerate the era of synergies with its present two equipment device suppliers in the solution range, as nicely as product or service sale, progress and manufacturing.

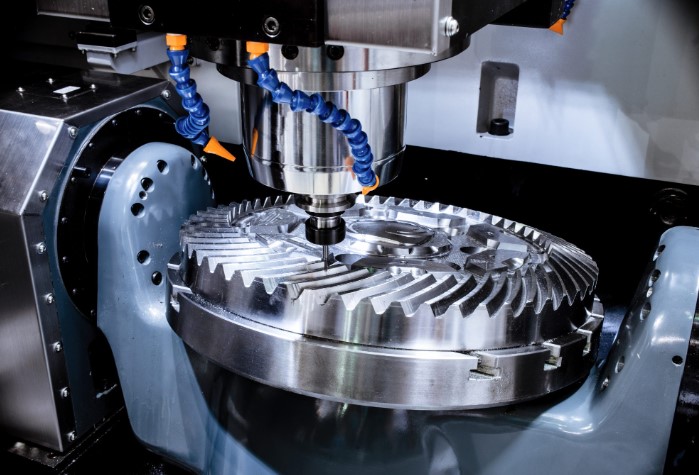

PAMA is a single of the most effectively-identified businesses in the machine device field for the huge vary of merchandise lineup and the substantial-amount technological capabilities of its significant device tools, significantly monotonous and milling equipment. The firm is also acknowledged for its good product sales and assistance networks in Europe and other sites such as China, the U.S., and India.

Nidec Equipment Device Company and Nidec OKK Company, whose most important products and solutions are gear reducing equipment, significant equipment tools and machining centers, have been in need to have of even further creating the multitasking and 5-axis machining technological innovation as perfectly as increasing its lineup of tedious and milling devices in the big equipment equipment room. Also, equally companies’ main gross sales region has been in Japan and, compared with other big Japanese machine tool brands, the two providers have created a lot less product sales from overseas markets these types of as European and American marketplaces and Chinese current market, exactly where the foreseeable future growth is anticipated.

Adhering to completion of the acquisition of PAMA, through reciprocal use of management resources among PAMA and the two device device companies, the Nidec Team intends to go after synergies in all the locations of sale, manufacturing, and solution advancement, together with:

- Expanding income in the Asian, European and American marketplaces based mostly on a extensive array of merchandise lineup and cross-promoting

- Developing new items and elements by combining the companies’ technological expertise and

- Reducing lead time for delivery and producing value primarily based on a international manufacturing optimization in Europe, the US, and Asia.

Right after completing the acquisition, the business will actively provide PAMA with sources and make vital investments in PAMA to accelerate the expansion of Nidec’s device tool company, which will add to the improvement of the device instrument market place on a global scale.

The acquisition is expected to have no sizeable affect on the company’s consolidated financial efficiency for this fiscal yr ending March 31, 2023. If required, the business will make more disclosure on a timely foundation in accordance with the rules of the Tokyo Inventory Trade upon determination of even further aspects.