Palantir & DocuSign Likely Bottomed, Which Stock Is Better Buy

NicoElNino/iStock via Getty Images

Investment Thesis

Software or SaaS stocks have been massacred over the past six to seven months from their November highs. However, given their massive growth premium in November, driven by the Fed’s liquidity binge, their spectacular collapse should not be surprising. High-growth SaaS plays that we track traded at NTM revenue multiples of more than 36x at their highs in November.

The pummeling has brought the valuation of these high-growth companies to much more reasonable metrics, at 9.2x as of June 2. Notwithstanding, the application software industry forward P/E of 29.3x still traded at a premium against the tech sector’s forward P/E of 20x. However, the industry’s 5Y EPS CAGR of 30.3{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} is much faster than the tech sector’s average of 14.9{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847}.

Consequently, application software stocks generally are seemingly undervalued. It has an industry forward PEG ratio of 1x, compared to the tech sector’s forward PEG ratio of 1.3x. As a result, we believe that the worst sell-off we have witnessed in recent times in software stocks should be behind us.

Our price action analysis also suggests that two enterprise SaaS stocks should deserve investors’ attention now. DocuSign (NASDAQ:DOCU) has formed a potent double bottom bear trap in May that could indicate a significant reversal in its downward bias. In addition, Palantir (NYSE:PLTR) stock is close to validating its double bottom price action. Therefore, we urge investors to pay close attention to these two SaaS plays.

Notably, these two companies are free cash flow (FCF) profitable. Therefore, they are unlikely to face any liquidity crunch despite the macro headwinds.

We reiterate our Buy rating on PLTR stock and also revise our rating on DOCU stock from Hold to Buy. We discuss why PLTR is the better buy now.

Software Stocks Have Been Crushed

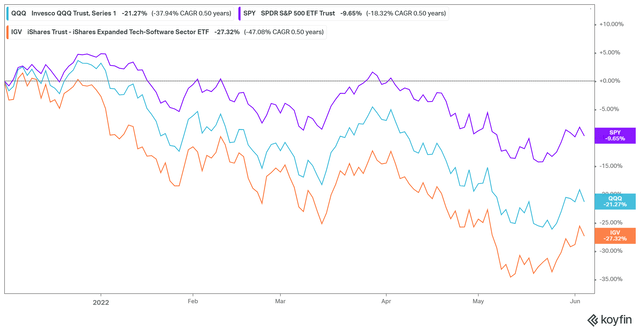

IGV ETF 6 months performance {64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} comps (koyfin)

Software stocks, as represented by the iShares Expanded Tech-Software Sector ETF (IGV), underperformed the Invesco QQQ ETF (QQQ) and the SPDR S&P 500 ETF (SPY) over the past six months. The IGV’s 6-month performance of -27.32{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} trailed the QQQ’s -21.27{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} and the SPY’s -9.65{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847}.

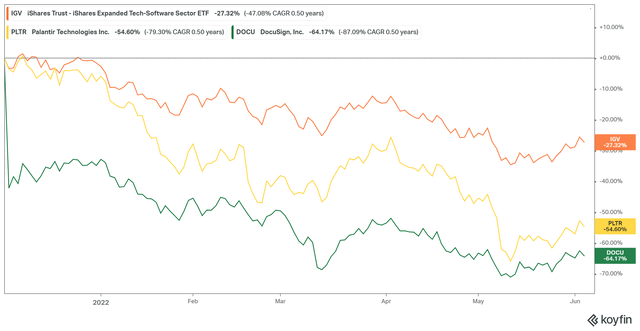

PLTR Vs. DOCU 6 month performance {64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} comps (koyfin)

Furthermore, PLTR and DOCU have fared even worse than IGV in the past six months. DOCU posted the worst 6-month performance of the duo, with a return of -64.17{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847}. Therefore, we believe the battering in SaaS stocks has been massive. However, the industry’s valuation collapse is necessary to reset the market’s expectations of much slower growth in 2022. The market’s prescience has been truly remarkable.

But, Growth Is Coming Back In 2023

Investors are urged to look forward like the market did. We discussed earlier that the application software industry has seen its forward PEG ratio fall to 1x. Consequently, we believe that software stocks generally have fallen into the undervalued zone. But, it’s crucial to choose only free cash flow (FCF) profitable stocks that can help them tide through the harsher macro environment.

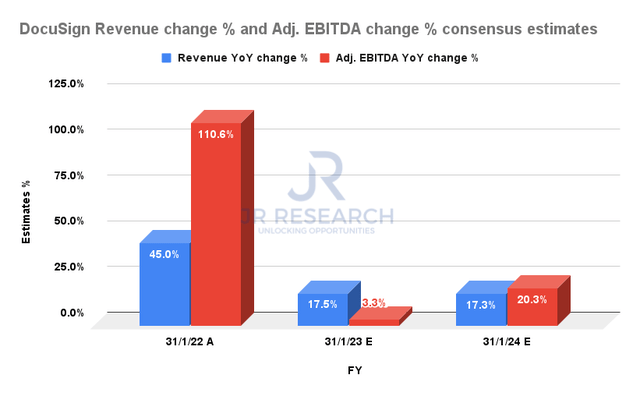

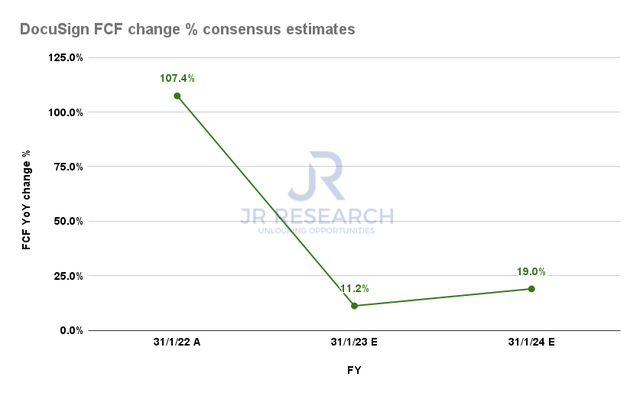

DocuSign revenue change {64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} and adjusted EBITDA change {64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} consensus estimates (S&P Cap IQ) DocuSign FCF change {64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} consensus estimates (S&P Cap IQ)

DocuSign is slated to report its FQ1’23 earnings release on June 9. Unfortunately, it has been a victim of its success, as the pandemic drove its growth to new heights. Also, the company was let down by poor execution, as management’s guidance over its post-pandemic outlook was overstated. As a result, the stock was justifiably punished.

Even CEO Dan Springer’s commitment to sharpening its post-pandemic execution and guidance couldn’t prevent the stock from falling further. Notably, Springer undergirded his confidence in DOCU stock’s long-term thesis, as he made substantial insider purchases worth about $12.41M since December 2021.

Furthermore, the consensus estimates suggest that DocuSign’s spectacular topline growth during the pandemic is over. However, the company’s adjusted EBITDA growth is estimated to reach a bottom in FY23 before posting a growth of 20.3{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} in FY24 (Vs. revenue growth of 17.3{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847}). As a result, DocuSign’s inherent operating leverage should help the company recover its profitability growth remarkably moving forward.

DocuSign is also estimated to post robust FCF growth in FY24, in line with its adjusted EBITDA estimates. Therefore, we think DOCU investors can start to look forward to a marked recovery in sentiments.

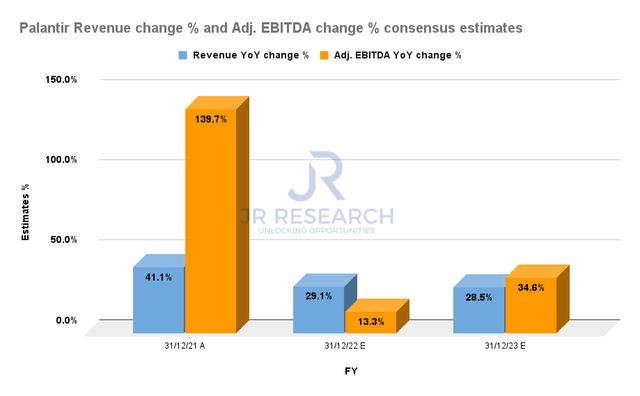

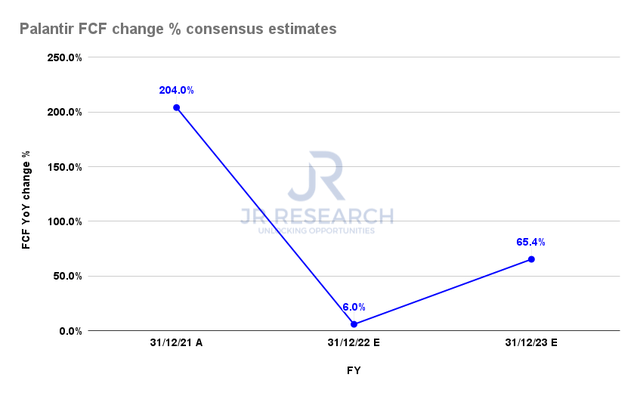

Palantir revenue change {64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} and adjusted EBITDA change {64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} consensus estimates (S&P Cap IQ) Palantir FCF change {64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} consensus estimates (S&P Cap IQ)

Palantir stock almost saw near-complete destruction in the recent May sell-off. At its May bottom, the stock lost more than 85{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} of its value from its 2021 highs. Furthermore, it fell below its IPO lows, as we emphasized in our previous article that it could represent a potential capitulation signal.

We are pleased to inform readers that PLTR stock’s capitulation signal is close to being validated. We shall discuss more in our price action analysis subsequently.

Notably, Palantir’s adjusted EBITDA is estimated to post a significant recovery in FY23, despite slightly lower revenue growth from FY22. As a result, we think the inherent operating leverage of SaaS companies like Palantir would be critical to help drive their profitability growth moving forward. Moreover, the consensus estimates suggest that Palantir could post a spectacular 65.4{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} YoY increase in FCF in FY23. We urge investors to start looking forward as SaaS stocks begin to make their recovery.

Palantir And DocuSign Are Highly Relevant For Enterprise

We think both companies are critical enterprise software plays in the digitization era. However, we prefer Palantir’s fundamental thesis better, given how it has proved itself with the US Department of Defense (DoD). The company has demonstrated its critical partnership with the US government, and we think it has no clear rivals.

Furthermore, we think the company will be a critical beneficiary of increased defense spending by the EU. The Russia-Ukraine conflict has fundamentally altered the geopolitical sphere between the EU and Russia. As a result, Palantir’s operating system should gain more prominence as the EU raises its defense budgets, supporting its government segment growth. In addition, its commercial segment has continued to gain significant ground, outperforming the growth in its government segment lately.

Notwithstanding, Palantir has faced significant challenges in ramping its commercial profitability, which has impacted its overall adjusted EBIT margins. However, a boost in the EU defense spending could lift its margins profile moving forward as it continues to diversify with its commercial segment.

DocuSign has proved its use cases during the pandemic, as companies shifted to transform their documentation from paper to the cloud. The growth in its Document Cloud remains robust, even though it has slowed tremendously, affecting its topline growth, as discussed previously.

However, the company highlighted that it’s lapping several single-use cases spurred by the government’s Payroll Protection Program (PPP) loans. These PPP loans have been instrumental in helping the SMBs toward the rapid adoption of their offerings during the pandemic. However, with the US economy reopening, these single-use cases have started to drop off, impacting its revenue comps.

Furthermore, DocuSign also articulated that some companies pulled forward their spending during the pandemic, resulting in slower renewals growth. Coupled with subpar execution in a more normalized operating environment, the company has faced significant challenges replicating its growth cadence in 2022. However, we highlighted that all this should pass soon, as it laps highly challenging comps. Growth has normalized but should recover remarkably in FY24. As a result, we are optimistic heading into DocuSign’s FQ1 earnings card.

Price Action Is Highly Constructive

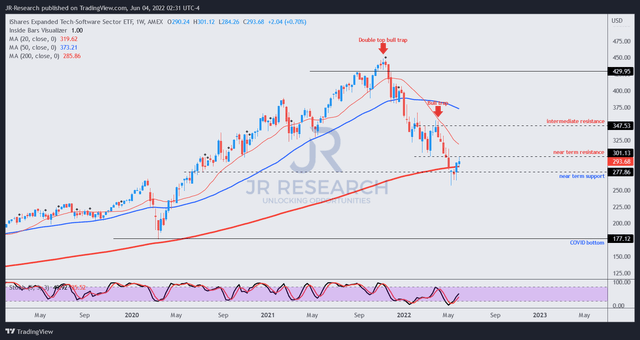

IGV price chart (TradingView)

The IGV ETF was hit by a massive distribution after its double top bull trap in 2021, followed by significant digestion of its gains, as seen above. Another bull trap occurred in March, forcing its price down further.

However, we noticed that the ETF has held up against its near-term bottom (but no bear trap yet). It’s attempting to retake its near-term resistance, which should bode well for sentiments if successful.

In addition, we think the 200-week moving average (thicker red line) should help undergird its near-term support, as SaaS valuations are generally attractive now. Therefore, we believe the sentiments over software stocks should improve significantly moving forward.

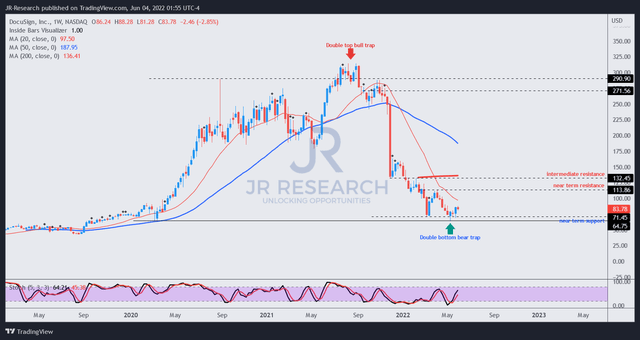

DOCU price chart (TradingView)

DOCU stock also formed a formidable double top bull trap in 2021, after drawing in buyers rapidly. The subsequent digestion of its gains was massive, as the market sold off rapidly. It has also formed a potent double bottom bear trap that could augur well for the potential recovery of its upward bias.

Conservative investors can wait for a re-test of its support. Notwithstanding, our medium-term PT of $110 implies a potential upside of 31.3{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847}. Again, we are confident that its near-term support should hold robustly.

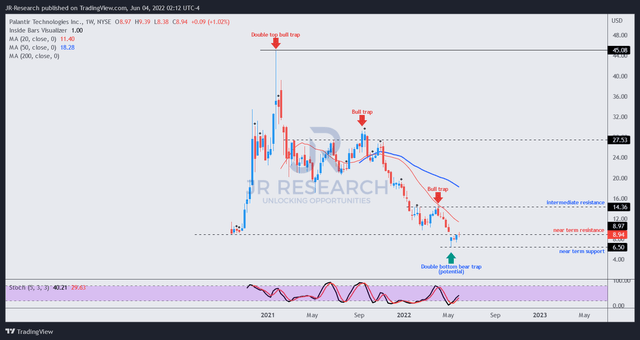

PLTR price chart (TradingView)

PLTR stock has held its near-term support in the May sell-off but has yet to validate its double bottom bear trap. However, it’s very close, so we will be watching closely. We think the underlying metrics should continue to lift the market sentiments in PLTR stock from its May capitulation signal and validate its bear trap soon.

Our medium-term PT of $13.50 implies a potential upside of 51{64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847}.

Which Is The Better Buy?

Between the two enterprise SaaS plays, we prefer PLTR now. We believe Palantir has not been impacted by pandemic pull-forward headwinds and has continued its robust growth. The company has also modularized its commercial offerings, which led to solid adoption. As a result, its commercial growth has continued to gain momentum, even though government growth decelerated. But, we think its government segment’s momentum will resume momentum, given the worsening geopolitical backdrop.

DocuSign needs to prove its execution in a more normalized post-pandemic enterprise backdrop. Furthermore, companies have started to cut enterprise spending, which could impact the company’s recovery momentum. Management needs to regain investors’ confidence that it can successfully navigate the reopening headwinds to meet its FY24 estimates of much more robust growth rates. Notwithstanding, we believe that DocuSign’s fundamental thesis remains intact, with strong underlying FCF metrics.

Our price action analysis suggests that both stocks are at significant near-term bottoms. As a result, investors can start to layer in their exposure to both companies.

We reiterate our Buy rating on PLTR stock. We also revise our rating on DOCU stock from Hold to Buy.

However, if SaaS investors are keen on adding just one of them, PLTR is our preferred buy.