Vietnam’s Machinery and Equipment Industry: Market Trends, Key Players

Vietnam’s equipment and machines market has been expanding appreciably, contributing to greater GDP and sub-sector industries. Vietnam Briefing requires an in-depth look and highlights critical tendencies and opportunities for overseas investors in the marketplace as Vietnam pushes ahead with its growing financial system.

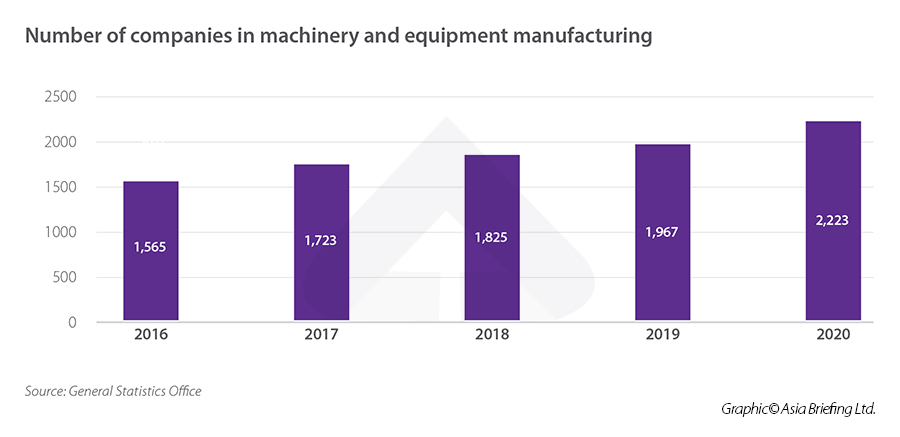

Vietnam’s equipment and machines sector has expanded significantly in the previous ten years. This is proved by the net profits recorded by corporations running in this business expanding at a compound once-a-year development level (CAGR) of 14.3 p.c between 2010 and 2019. Until 2020, there were about 2,200 firms specializing in the output of machinery and products in Vietnam, earning full earnings of US$4.6 billion.

Inspite of a promising market place, domestic equipment makers have not been in a position to fulfill sector need. Only 32 {64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} of need is supplied by area organizations, according to the Vietnam Association of Mechanical Marketplace (VAMI). The remaining 68 percent of market place demand from customers is provided by imported products and solutions owing to sizeable desire and out-of-date generation technology by domestic suppliers.

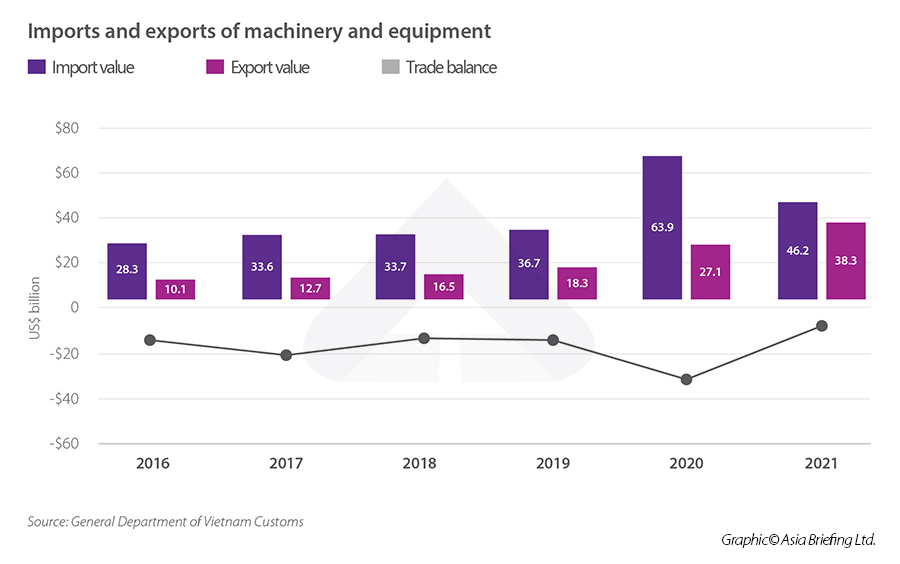

The dominant share of overseas suppliers for machinery and machines in Vietnam has remained continuous in the final decade. In 2021, the import benefit of machinery and gear hit US$46.3 billion, an increase of 24.3 {64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} when compared to the preceding year.

Important suppliers of equipment to Vietnam have been Asian countries such as China, South Korea, Japan, and Taiwan. These accounted for about 70 p.c of the overseas resources for machinery in the Vietnamese current market owing to their aggressive charges and prevailing buyer preference. Other noteworthy exporters have been ASEAN nations together with Thailand, Malaysia, and Indonesia as perfectly as western nations this kind of as Germany, US, and Italy.

Possibilities for foreign buyers in big industries

Agricultural equipment

Agriculture is historically an vital financial sector of Vietnam where it contributed to 12.4 p.c of the country’s GDP in 2021. Having said that, all-around 30 percent of farms in Vietnam remain unmechanized.

In latest yrs, the sector has witnessed a converging craze of scattered small-scale farms to concentrated substantial-scale corporations with an escalating emphasis on mechanization and automation. Accompanied by inhabitants development, urbanization, and better efficiency demand with shrinking agricultural land, the development in need for agricultural machinery is expected to be robust in the coming many years.

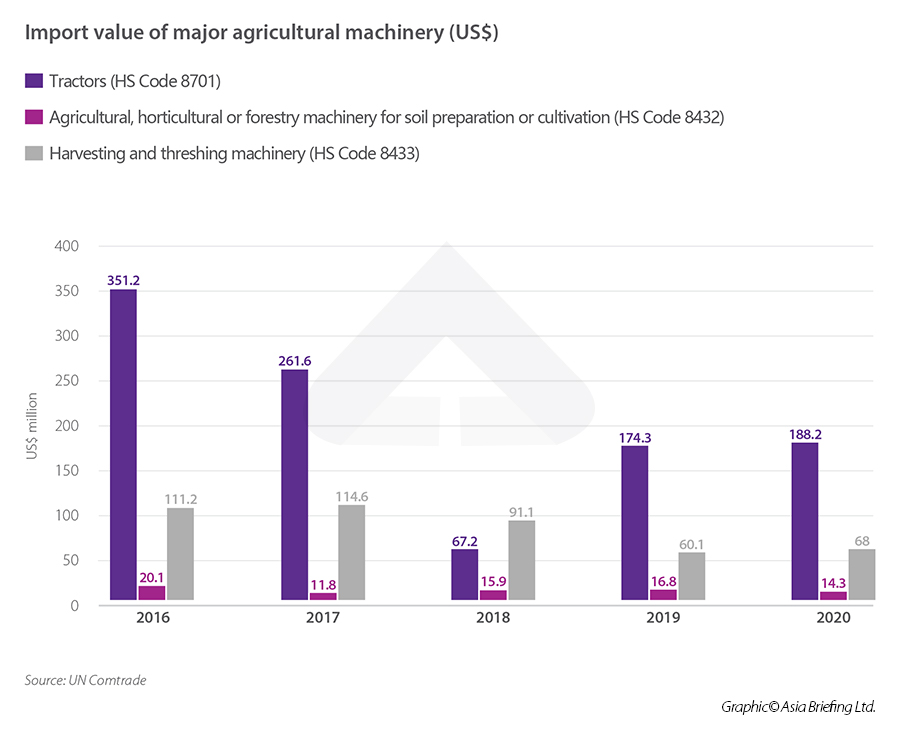

In the meantime, Vietnam is only self-enough for 30 to 40 percent of agricultural machinery with the remaining equipment imported typically from China and Japan. That mentioned, the agricultural equipment production segment is growing fast and has fairly offset the hole amongst domestic source and market place need. Import value of vital goods, like tractors, soil preparing, cultivation, and harvesting equipment, has declined at a CAGR of 13.5 p.c throughout the 2016 to 2020 interval.

The two overseas and domestic players are active in the agriculture equipment current market.

Domestic enterprises engage in important roles in this phase considering that these organizations count additional on immediate sales fairly than distributing items through brokers and 3rd-occasion distributors. Also, Vietnamese firms are inclined to superior realize and seize the require of neighborhood farmers.

Top businesses in the segment are Vietnam Motor and Agricultural Machinery Corporation (VEAM), Hanoi Agricultural Equipment and Agricultural Extension Corporation (HAMCO), and Vietnam Institute of Agricultural Engineering and Put up-Harvest Technologies (VIAEP).

Leading overseas corporations operating in Vietnam include Kubota, Iseki and Yanmar (Japan), CNH Industrial (United states-Italy), CLAAS KGaA GmbH (Germany), Buhler (Switzerland), ShanDong Huaxin Equipment (China), and Tong Yang Moolsan (South Korea). These manufacturers rely mainly on their agent and distributor community to enter and increase in the Vietnamese industry.

Aside from producing and distributing in Vietnam, rising possibilities for overseas equipment models lie in technologies transfer for regional corporations and customized selecting in a densely cultivated area.

A notable position design is the cooperation among Truong Hai Vehicle Corporation (THACO), the local automotive giant, and LS Mtron, the major agricultural machinery producer from South Korea. THACO a short while ago opened a US$22 million plant in Chu Lai Open Economic Zone (Quang Nam province) to create agricultural tractors, harvesters, and farming equipment.

The corporation acquired technology and instruction from LS Mtron. LS Mtron transfers tractor manufacturing know-how to THACO and helps THACO in schooling engineers in get to enable the Vietnamese producer to get to a regional worth information of up to 50 percent.

Yet another emerging organization product is custom made selecting of agriculture equipment as the area output of agriculture machinery is insufficient. Agricultural co-operatives and private enterprises are the providers of machinery for use. Tillage, harvesting, threshing, drying, grain storage, and transportation are handled by companies that give selecting expert services. This sort of firms are predominantly in the Mekong River Delta and Pink River Delta locations.

Industrial machinery

A short while ago, Vietnam come to be a key choice producing destination for businesses that are searching for to diversify their offer chain amid uncertainties brought about by the pandemic and the US-China trade war.

In 2020, Vietnam experienced about 110,000 corporations in the production sector, which was roughly 2.5 periods larger than in 2010. Web earnings of production industries went up from US$100 million in 2010 to just about US$450 million in 2019.

Having said that, GSO’s study on manufacturing and company disorders of Vietnamese enterprises in 2021 discovered that the previous and underdeveloped generation lines of about 20 percent of industrial enterprises have a significant adverse outcome on their business enterprise functions.

Even more, organizations are also banned from importing utilised equipment that is additional than 10 years outdated under Decree No 18/2019/QD/TTg on imports of made use of machinery, gear, and technological traces.

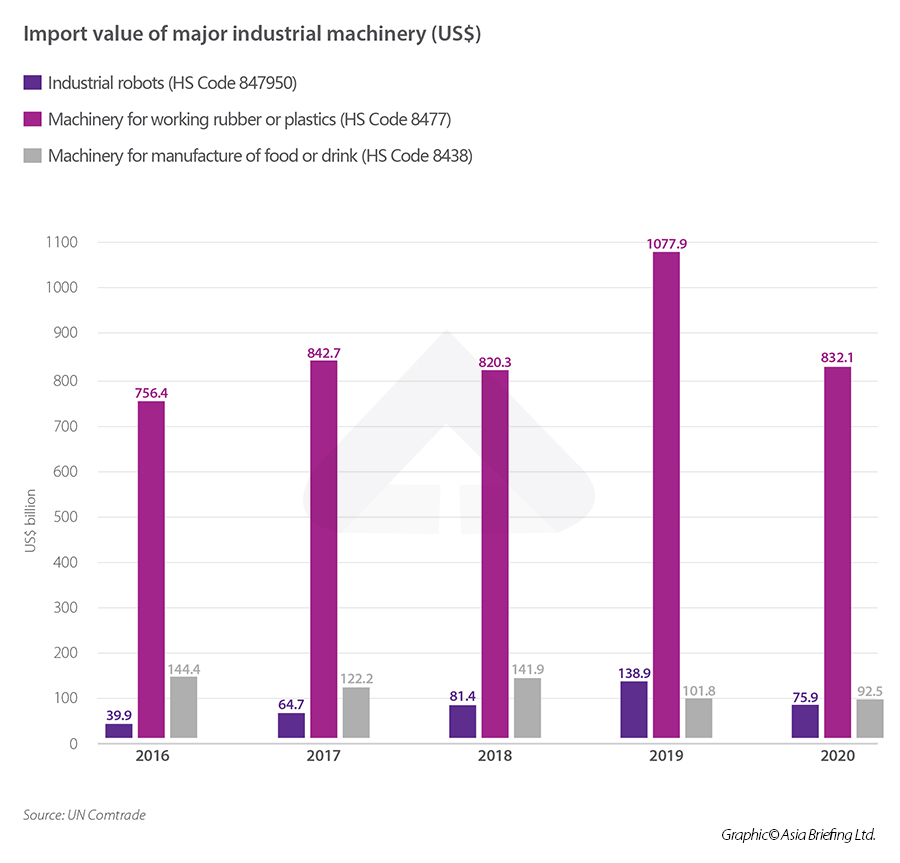

Accompanied by a growing number of new corporations becoming a member of the sector, there is an expanding demand from customers for new industrial machinery, especially in the meals, pharmaceutical, plastics, and chemical industries.

Big equipment, in particular substantial-tech and complex kinds, are continue to imported.

Likely ahead, the most promising phase for foreign businesses is robotics and automation. According to a survey by the Provincial Competitiveness Index (PCI), from 2018 to 2020, 67 per cent of each foreign and domestic investors automatic a element of their operations, whilst 75 {64d42ef84185fe650eef13e078a399812999bbd8b8ee84343ab535e62a252847} prepare to automate new jobs all through the future 3 yrs.

In 2021, the robotics and automation market place in Vietnam was believed to be well worth US$184.5 million. The market place is dominated by foreign brand names, like ABB, Yaskawa, Fanuc, Kawasaki, Kaku, Common Robotic, etc. These major brands’ shopper base in Vietnam are largely significant-scale international-invested and personal corporations with ample spending budget for financial commitment in automation. They work intently with the licensed distributors and seller networks in Vietnam to extend their footprint.

Construction equipment

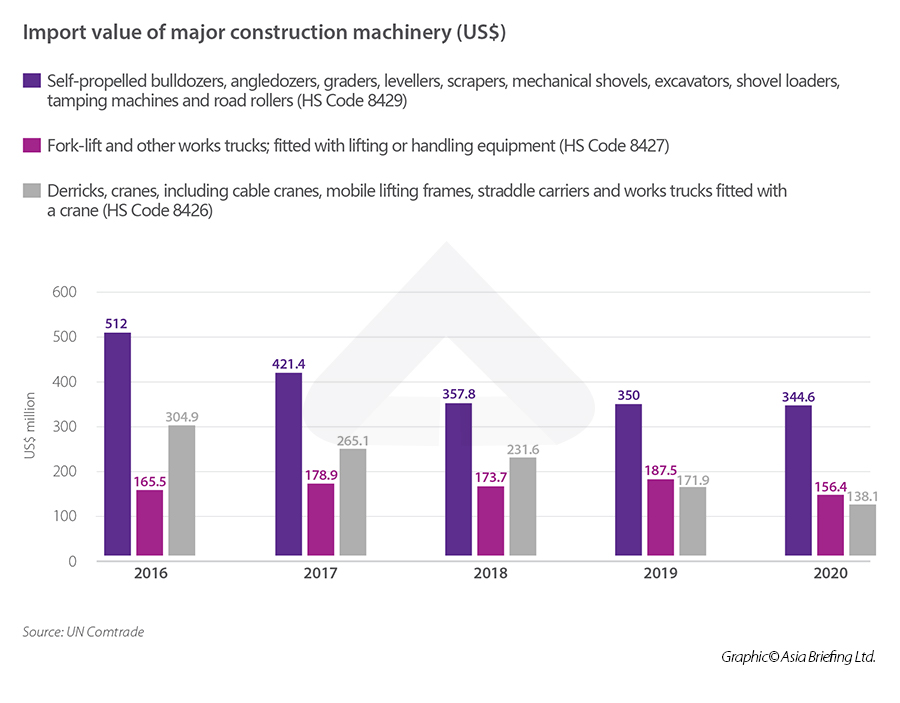

The Vietnam building gear sector has grown in recent years, owing generally to its growing development and infrastructure progress assignments.

There were above 91,000 contractors operating in Vietnam as of 2020, with about a half specializing in residential development. Having said that, Vietnam does not have advanced development equipment manufacturing capacity and for that reason is dependent just about completely on imported machinery.

Vietnam largely imports machines from Japan, China, and the US with well-recognized brands like Komatsu (Japan), Hitachi (Japan), Kobelco (Japan), Doosan (Korea), Hyundai (South Korea), Daewoo (South Korea), and Caterpillar (US).

In phrases of products styles, earthmoving devices qualified prospects the general Vietnam building devices current market, principally because of to the country’s expanding community infrastructure amenities. Cranes and substance handling gear are also viewing expansion in the market.

Total, the Vietnamese market for construction machines is in particular beautiful to machinery rental firms. New gear comes with substantial financial investment though leasing utilized machinery decreases important investment decision as very well as transportation, storage service fees, interest on bank loan quantities, registration, insurance policies, and tax on new devices for contractors.

Vital success things for foreign rental companies in the current market involve correct pricing strategy, assorted and up-to-date product or service portfolio, qualified operator crew, and strong partnership with other stakeholders in the market.

Market entry technique

The equipment and gear sector in Vietnam is comparatively open up to international investors. Current market access circumstances are generally in terms of environmental security for expense in producing. Additionally, 100 p.c overseas-owned businesses are authorized in the production and investing company of equipment and machines.

The ideal marketplace entry strategy for foreign firms will fluctuate relying on various elements, like the finances for investment decision and the growth of supporting industries in Vietnam.

However, setting up a subsidiary in Vietnam or collaborating with a associate, possibly through a distributor or an original gear producer (OEM), are two of the most common possibilities for multinational equipment models.

Investing in the machinery sector

International machinery businesses considering opening a manufacturing and buying and selling facility in Vietnam to create and distribute their products regionally as very well as export to other marketplaces ought to get into account a sizeable investment decision as nicely as the feasibility of structuring a stable source chain for the Vietnamese factory. Even while Vietnam’s mechanical engineering sector is promptly growing, only a small percentage of brands are equipped to produce products and solutions that accomplish international high-quality criteria.

Developing a buying and selling business to import and distribute the equipment of the mum or dad business is a suited option for buyers with a constrained price range or who are not able to find adequate local suppliers for areas and factors. Using a area group less than the mother or father enterprise has also demonstrated to be effective in terms of branding and taking care of the vendor community.

Connecting with nearby associates

Some foreign enterprises with a limited expenditure price range that would like to test the industry may possibly decide on to do the job with regional partners such as equipment distributors and sellers, as nicely as first equipment makers (OEMs). Even if they are not physically existing in the focus on market place, collaboration with a neighborhood business is an affordable marketplace entry system.

Local companies serving as approved distributors are a advantageous organization channel due to their in-current market encounter and high-price community of sellers and customers, which will assist new enterprises attain their possible clients in a shorter timeframe and with considerably less effort.

Collaboration with OEMs can be a successful product for some makes. On the other hand, this approach depends mainly on the variety of equipment. Community producers have proven their strong capability in conditions of agriculture equipment lines even though currently being fewer aggressive at intricate industrial tools and heavy development devices.

Irrespective of the market place entry approach, overseas models should really take into consideration and aim on 1 essential factor, which is a perfectly-designed dealership community. These dealers contribute to brand name awareness and give a detailed sales and support community that help their solutions.

About Us

Vietnam Briefing is developed by Dezan Shira & Associates. The organization helps overseas investors all through Asia from offices throughout the earth, which include in Hanoi, Ho Chi Minh Town, and Da Nang. Readers may possibly create to [email protected] for much more assist on undertaking business in Vietnam.

We also preserve offices or have alliance partners helping international buyers in Indonesia, India, Singapore, The Philippines, Malaysia, Thailand, Italy, Germany, and the United States, in addition to procedures in Bangladesh and Russia.